The Impact of Virtual Corporate Cards on Business Expense Management

Introduction

In today’s fast-moving economy, keeping spending under control is vital for any organization. Virtual corporate-card solutions have quickly become a preferred way to simplify this task. This article reviews how these digital tools reshape expense workflows, highlights their advantages and hurdles, and looks at what lies ahead for companies that adopt them.

What is a Virtual Corporate Card?

Definition and Overview

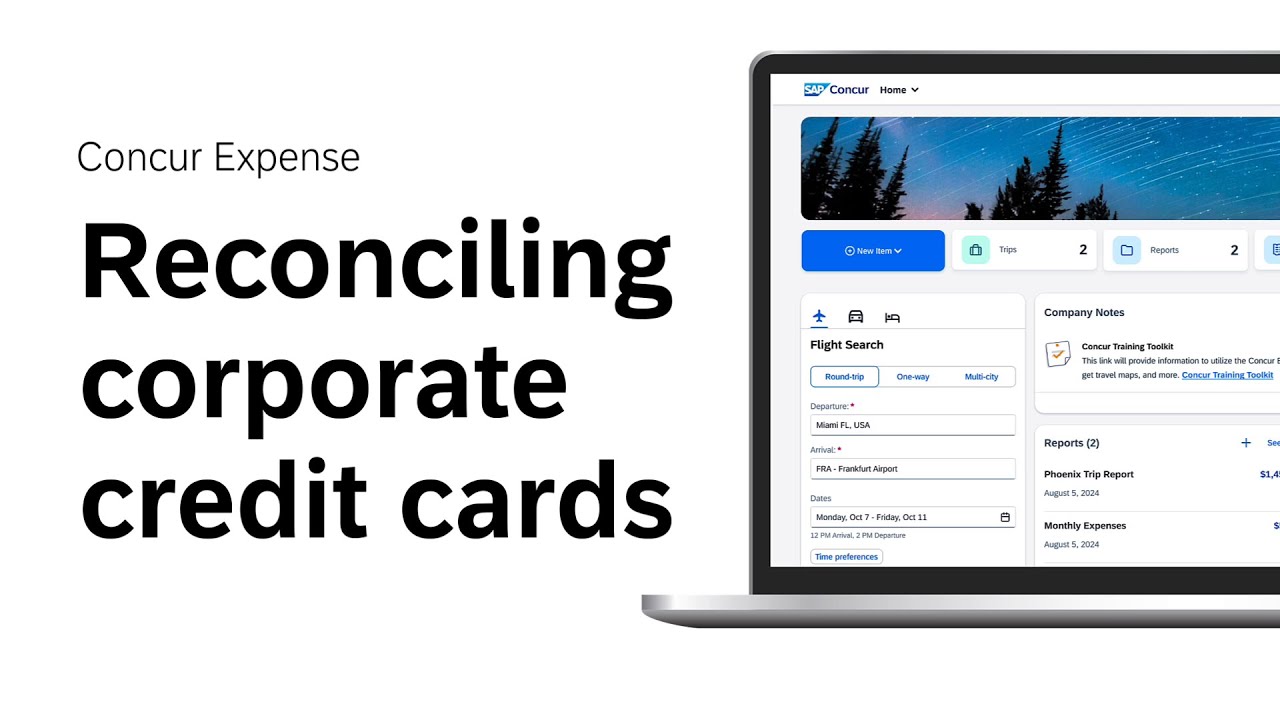

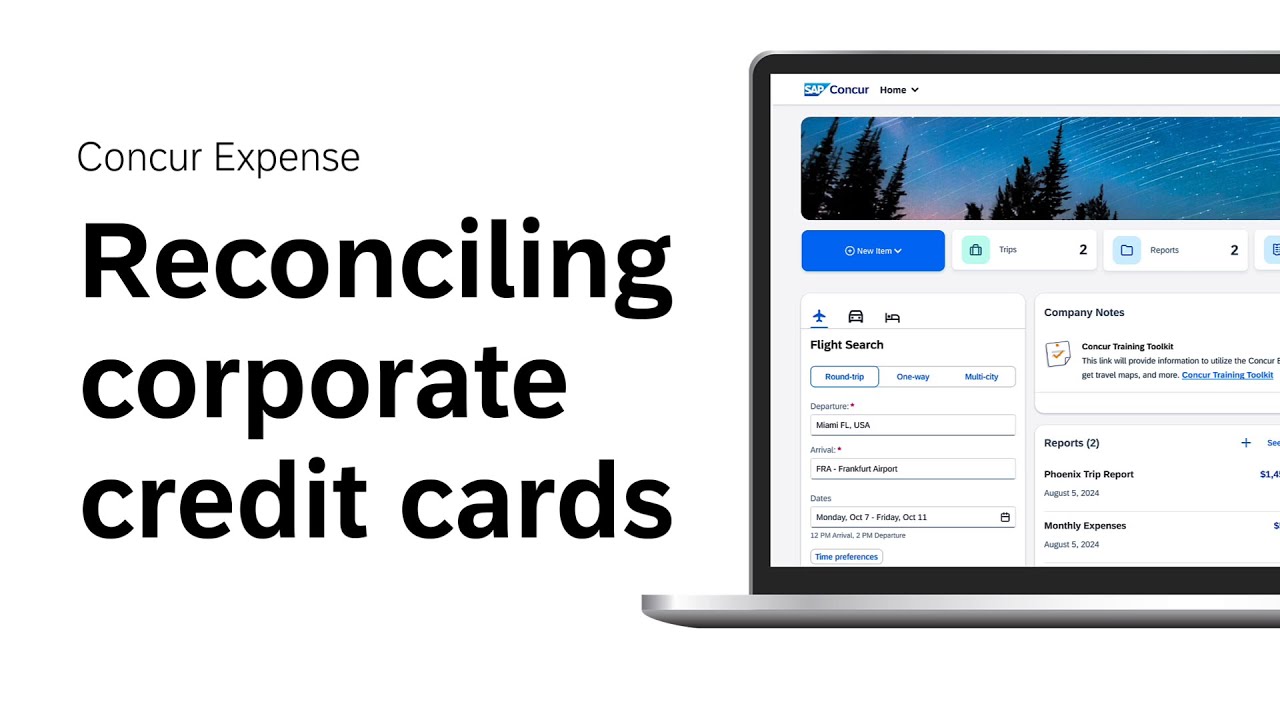

A virtual corporate card is a digital payment method issued to employees for business purchases. It works like a regular credit card but exists only in electronic form. Integrated with expense platforms, it centralizes issuance, reporting, and reconciliation, cutting the manual workload for finance teams.

Benefits of Virtual Cards

Streamlined Expense Management

Because the card feeds transaction data straight into expense software, receipts are matched and categorized automatically. This removes tedious data entry, accelerates month-end close, and lowers the risk of human error.

Real-time Expense Tracking

Spending updates appear instantly on dashboards, giving managers live visibility into budgets. Teams can spot trends early, adjust forecasts, and curb overspending before it accumulates.

Enhanced Security

Single-use card numbers, spend limits, and instant notifications reduce the chance of fraud. If suspicious activity occurs, the card can be frozen immediately without affecting other payments.

Challenges of Adoption

Initial Setup and Training

Launching the program requires mapping expense policies, configuring rules, and teaching staff new habits. Organizations with lean IT teams may need extra time or external support to complete rollout smoothly.

Integration with Existing Systems

Connecting virtual-card data to legacy accounting or ERP platforms can be tricky. Clean, consistent data formats and API compatibility are critical to avoid reconciliation headaches later.

Case Studies and Success Stories

Case Study 1: Global Manufacturing Firm

A diversified manufacturer with thousands of staff replaced traditional cards with virtual ones across forty countries. Administrative hours dropped sharply, and finance gained real-time insight into plant-level spending, freeing budget for strategic projects.

Case Study 2: Growing Professional Services Company

A mid-size consultancy issued virtual cards to project managers. Employees appreciated the instant availability of funds, while the finance team cut reimbursement cycles by half and virtually eliminated out-of-policy purchases.

Future Implications and Recommendations

Emerging Technologies

Artificial intelligence is beginning to flag anomalous spend patterns automatically, while blockchain pilots promise tamper-proof audit trails. As these tools mature, expect even tighter control and faster reconciliation.

Best Practices for Implementation

To maximize value, organizations should:

1. Perform a detailed needs assessment to align card features with policy goals.

2. Engage stakeholders early so that finance, IT, and end-users share a common vision.

3. Offer role-based training and quick-reference guides to encourage correct usage.

4. Schedule periodic reviews to adjust limits, categories, and approval flows as the business evolves.

Conclusion

Virtual corporate cards have moved from novelty to necessity for firms seeking agile, transparent expense management. By automating data capture, strengthening security, and delivering real-time analytics, they empower organizations to control costs and focus resources on growth. With thoughtful rollout and ongoing refinement, companies of any size can turn everyday spending into a strategic advantage.